Background

The good thing about buzzwords is that they make a concept accessible to many. Many Product Management buzzwords were popularized by Silicon Valley startups. A few of these buzzwords were quickly picked by enterprises too. Especially by a bold & courageous executive leading transformation within an enterprise.

One such buzzword is Customer Experience (CX). It has helped enterprises cut through mountainous hierarchies, fragmented decision-making, and “approvals’ driven buerocracy. Customer Experience brought to table an Occam’s Razor variant:

If it improves a customer experience, it is the right thing to do.

So What is My Problem?

The bad thing about a buzzword like ‘Customer Experience’ is that it has turned an organization’s focus into a zero-sum game.

The biggest loser in this zero-sum game of Customer Experience is Employee Experience. Above that, the further an employee is from a Customer’s touch-point, the worse is the experience.

This is also evident from budgets assigned to the improvement of Customer Experience.

“Organizations have matured in their understanding of the business outcomes that CX delivers,” said Augie Ray, VP analyst, Gartner for Marketers. “As a result, the budget outlook is expected to grow to match. This raises the stakes for CX leaders to select metrics that demonstrate impact and prove the value of CX to business results.”

“Gartner Says 74% of Customer Experience Leaders Expect Budgets to Rise in 2020”. Press Release. January 15, 2020

A Case in Point: The $900m Gaffe

Almost all of us have heard about the $900m transfer from a large bank to a customer and then their struggle to get that money back.

For those who are not aware, this excerpt from a Bloomberg.com article is a great summary:

Last August, Citigroup Inc. wired $900 million to some hedge funds by accident. Then it sent a note to the hedge funds saying, oops, sorry about that, please send us the money back. Some did. Others preferred to keep the money. Citi sued them. Yesterday Citi lost, and they got to keep the money.

Matt Levine. “Citi Can’t Have Its $900 Million Back“. Bloomberg Opinion. February 17, 2021.

At the heart of this problem is a failure to address Employee Experience. Let us get right into it.

How the 3 Key Aspects of Employee Experience Were Ignored

- Well Designed User Interface,

- Workflow Rationalization, and

- Outcome over output

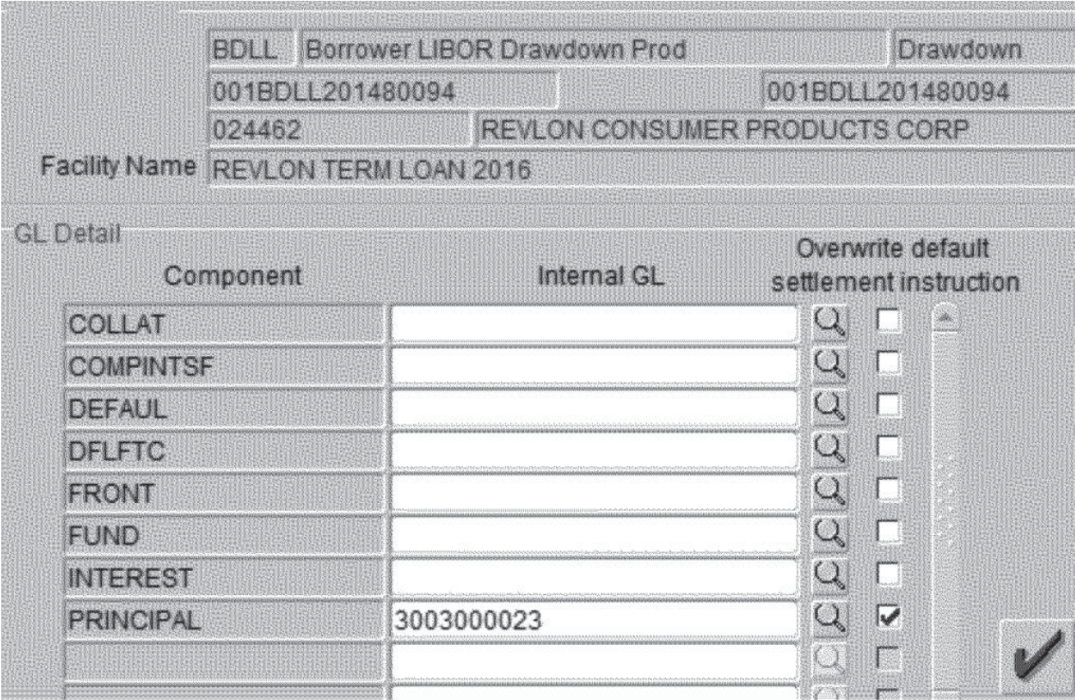

Well Designed User Interface

Products built for employees tend to have bulky, non-intuitive and laborious under interfaces. Most of these user interfaces are designed by a Business Analyst or worse, by a developer. Using such products requires lots of training, familiarity with jargon and excessive typing/clicking.

All these flaws seem to be present in this case.

The user interface is clearly not up to the mark. It is a primitive design, non-intuitive and does not communicate with a user very well.

Here is why:

1. The number once entered does not add visual markers of a comma. Ideally, the number should have looked like:

Principal: 3,003,000,023

This will immediately tell an employee about the size of the transaction, trigger more attention. Sometimes, giving a worded version also helps. Eg: 3 billion 3 hundred thousand and twenty three.

2. The labels are complex and non-intuitive. That means an Employee has to rely on training and refreshers to know what means what. Most importantly, it all depends if the employee recalls at that moment what means what. See that label:

“Overwrite default settlement instruction”

This check box actually means. “Don’t actually send the money”!

3. In order to complete the action, but not send the money, the employee has to check a box labeled: “Overwrite default settlement instruction”. If the employee misses this checkbox, it is a disaster.

This shows badly designed ‘default action’. Given the prominence of the “Overwrite default settlement instruction” checkbox, seems like “Don’t actually send the money” is not that rare a scenario.

So by default, the money should not have been sent and to send money an extra click was needed.

If a Maker forgot to click the button, the money would not have been sent. That can be fixed easily. Rather than the reverse: where money was sent when it should not have been. That is exactly what happened here.

Workflow Rationalization

Often the workflow is based on the peculiarities of the product in use rather than efficiency or employee experience. That is what has happened here too.

The Fund Sighting Manual explains that, in order to suppress payment of a principal amount, “ALL of the below field[s] must be set to the wash account: FRONT[;] FUND[; and] PRINCIPAL” — meaning that the employee had to check all three of those boxes and input the wash account number into the relevant fields.

Matt Levine. “Citi Can’t Have Its $900 Million Back“. Bloomberg Opinion. February 17, 2021.

This is a tedious workflow. It is non-intuitive, requires muscle memory about the peculiarities of the software and sets up an employee for making mistakes.

That is what exactly happened. The Maker and two other Checkers all missed the fact that only the Principal field was checked off. All three missed that Front and Fund should also have been checked off.

This tedious workflow only forced the hand of fate for such an error to happen.

Outcome over Output

It would be interesting to study how many such requests an employee makes in a data and how many such requested the checkers approve in a day.

Does a busy Manager get assigned checks at the rate where they can inspect the requests?

Does a request come along with a checklist? Ideally, based on the size of the transaction, the possible rules and possible outcomes the request should have a dynamically generated checklist for the approver. In this case, the list could have been:

- If the intention is not actually to send the money, are all three (Front, Fund and Principal boxes checked?

- The current request will lead to the transfer of $3,003,000,023 out of the bank to client. Please ensure this is the outcome intended

- This request usually takes (say) 15 mins to review and approve. Faster approval will flag as ‘at risk’ for the next reviewer

Conclusion

Obsession with Customer Experience has taken away oxygen from improvement experiences of other Users (mostly employees). Here is a self-check:

Does the internal set of software you use 8-10 hrs a day deliver customer-grade experience to you?

If not, don’t you and the other employees deserve better?